Markets and the Fed are at odds with each other as one tries to figure out what the other is thinking, and the Fed walks a tightrope between concerns about market stability and its inflation fighting mandate. And amid this back and forth, the 60/40 portfolio may be well poised to make a comeback, according to new insight from Morningstar Indexes.

A Seesaw of Expectations Between Markets & The Fed

“The markets appear to be pricing in the expectation of interest rate cuts from the Fed before year-end,” according to Morningstar’s Director of Fixed Income & Multi-Asset Indexes Katie Binns. “Yet recent comments from the Fed still suggest a high degree of concern about persistent inflation and the Fed’s most recent dot plot suggests a higher for longer rate environment.”

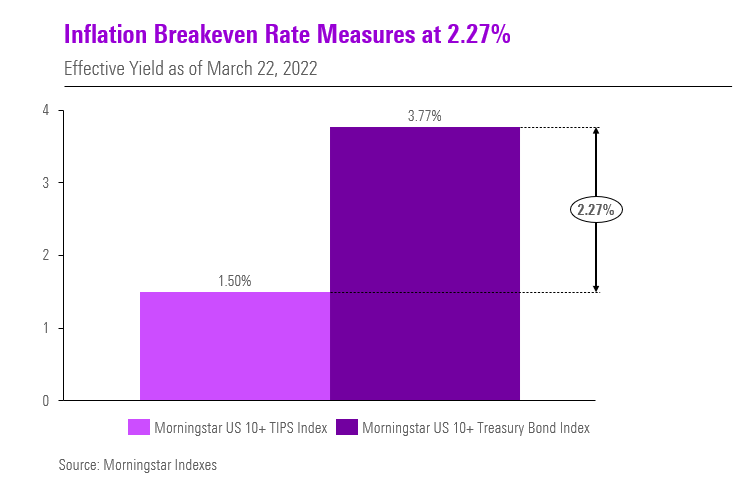

Yet markets may not be far off, according to Morningstar fixed income indexes. A comparison between effective yield for the Morningstar US 10+ Yr Treasury Inflection-Protected Securities Index and Morningstar US 10+ Yr Treasury Bond Index, typically considered a measure of the market’s longer-term outlook on inflation, shows an inflation breakeven rate of 2.27%, close to the Fed’s long-term target.

Volatility May Spell a Comeback for the 60/40 Portfolio

Meanwhile, as equity and fixed income markets ride a wave of heightened volatility in March, fueled by continued macroeconomic concerns and signs of instability in the global banking system, the traditional relationship between equity and fixed income appears to be returning.

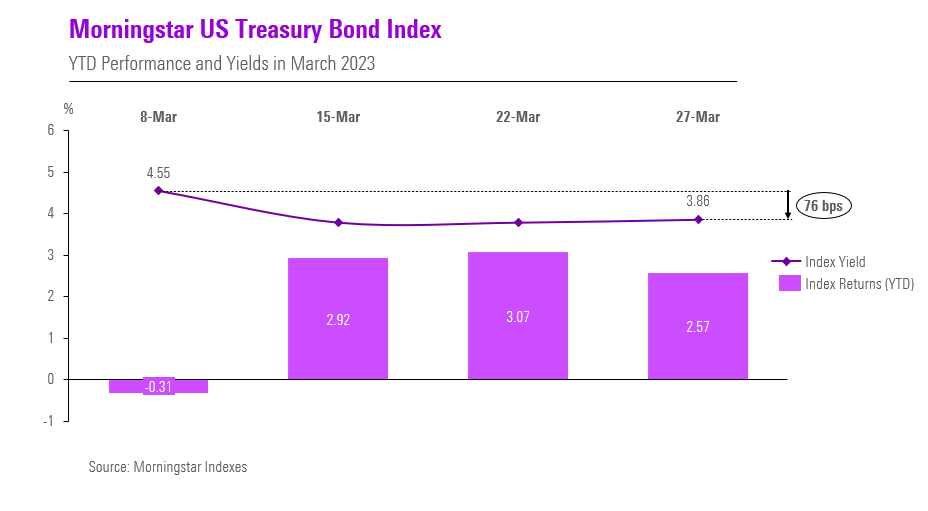

While equities have fallen in recent weeks, with a .5% decline for the Morningstar US Market Index, the Morningstar US Treasury Bond Index has rallied, currently up 2.57% year-to-date. The rally in fixed income performance comes as investors have flocked to safety, driving yields down and prices up.

“While it has certainly been a bumpy ride in 2023 with the prospect of more volatility ahead, we have seen the traditional diversification effect between stocks and bonds returning,” added Binns. “This speaks to the power of a broadly diversified portfolio to weather the storm.”

©2023 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.